Digital payment transactions volume grew to 18,737 crore in FY 2023-24 from 2,071 crore in FY 2017-18 at Compounded Annual Growth Rate (CAGR) of 44%; with value of transactions at ₹3,659 lakh crore in FY23-24 from ₹1,962 lakh crore in FY17-18 at CAGR of 11%

UPI transactions volume grew to 13,116 crore in FY 2023-24 from 92 crore in FY 2017-18 at CAGR of 129%; with value of UPI transactions reaching ₹200 lakh crore trillion in FY23-24 from ₹1 lakh crore in FY17-18 at CAGR of 138%

UPI now seamlessly facilitates live transactions in 7 countries, including key markets such as UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius

The Department of Financial Services (DFS), Ministry of Finance, plays a critical role in driving the promotion of digital payments in the country.

Efforts to accelerate the adoption of fast payment system like the Unified Payments Interface (UPI) has revolutionised the way financial transactions are conducted, enabling real-time, secure, and seamless payments for millions.

This initiative aligns with the Government’s vision of a cashless and inclusive economy, empowering every citizen in their financial decision.

In comparison with previous fiscal years, the digital payments landscape has demonstrated remarkable expansion in Financial Year (FY) 2023-24. Key insights include:

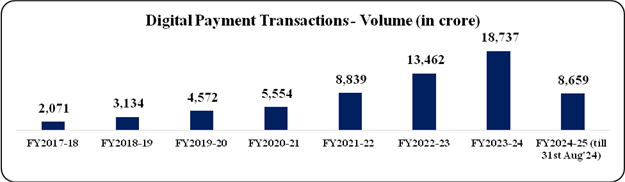

Growth in Digital Payment Transactions:

Digital payments in India have witnessed significant growth, with the total number of digital payment transactions volume increased from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24 at Compounded Annual Growth Rate (CAGR) of 44%. Furthermore, during the last 5 months (April-August) of the current financial year 2024-25, the transaction volume has reached to 8,659 crore.

Source: RBI, NPCI & Banks

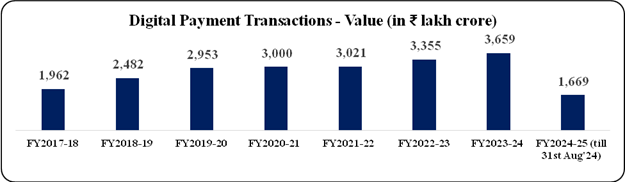

The value of transactions has grown from ₹1,962 lakh crore to ₹3,659 lakh crore at CAGR of 11%. Additionally, in the last 5 months (April-August) of the current financial year 2024-25, the total transaction value has surged to an impressive ₹1,669 lakh crore.

Source: RBI, NPCI & Banks

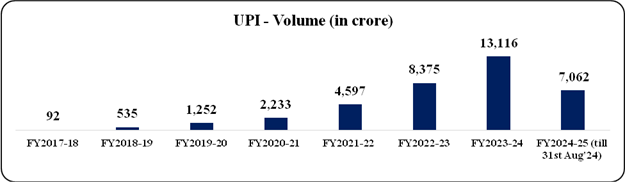

UPI’s Continued Success:

UPI remains the cornerstone of India’s digital payment ecosystem. UPI has revolutionised digital payments in the country, UPI transactions have grown from 92 crore in FY 2017-18 to 13,116 crore in FY 2023-24 at CAGR of 129%. Furthermore, during the last 5 months (April-August) of the current Financial Year 2024-25, the transaction volume has reached 7,062 crore.

The ease of use facilitated by growing network of participating banks and fintech platforms, has made UPI the most preferred mode of real-time payments for millions of users across the country.

Source: NPCI

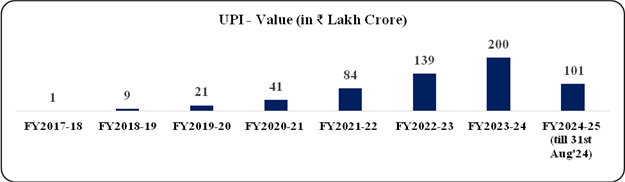

The value of UPI transactions has grown from ₹1 lakh crore to ₹200 lakh crore at CAGR of 138%. Additionally, in the last 5 months (April-August FY2024-25), the total transaction value has surged to an impressive ₹101 lakh crore.

Source: NPCI

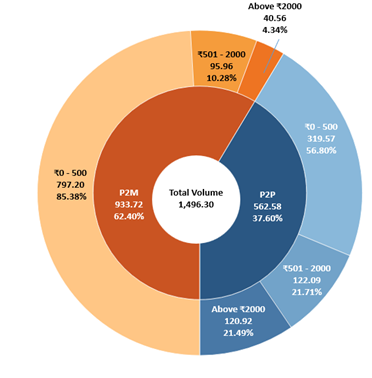

UPI: P2M and P2P Transactions (by Volume in crore) for Aug 2024

The contribution of P2M transactions reached 62.40% in Aug’ 2024, where 85% of these transactions are up to a value of ₹500. This indicates the trust that UPI enjoys among citizens for making low value payments.

UPI and RuPay Global Expansion:

India’s digital payments revolution is extending beyond its borders. Both UPI and RuPay are rapidly expanding globally, enabling seamless cross-border transactions for Indians living and traveling abroad. Presently, UPI is live in 7 countries, including key markets such as UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, Mauritius, allowing Indian consumers and businesses to make and receive payments internationally. This expansion will further bolster remittance flows, improve financial inclusion, and elevate India’s stature in the global financial landscape. As per ACI Worldwide Report 2024, in 2023 around 49% of the global real-time payment transactions is happening in India.

India is rapidly emerging as a global leader in digital payments. With UPI’s global expansion and the continued rise of digital transactions, India is setting new benchmarks for financial inclusion and economic empowerment of common citizen.

Department of Financial Services remains committed to advancing digital payment solutions that are secure, scalable, and inclusive, while also exploring new avenues to strengthen India’s position in the global financial ecosystem.